Housing Market Rebound Underway

A couple weeks ago we made the prediction that Spring 2015 will contain all the ingredients for a recipe of Real Estate success, both for buyers and sellers.

More good news boosts our theory.

HomeOwnership Rate to Rise

The resilient West Virginia housing market has prevailed when other states have failed.

The national homeownership rate fell to 63.9 percent at the end of last year. This was the lowest level in two decades, according to numbers from the U.S. Census Bureau.

However, West Virginia’s home ownership rate planted itself at 77.5 percent.

Economic analysts believe the national rate will rebound this year. If history proves true, then as the nation’s rate rises, so should West Virginia’s.

Foreclosures Drop

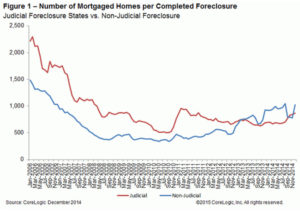

The number of completed foreclosures dropped across the U.S. in 2014, according to statistics from CoreLogic.

States with the lowest number of foreclosures include South Dakota, North Dakota, Wyoming and, you guessed it: West Virginia!

Once again, the Mountain State’s resiliency shines.

“The steady decline in the number of completed foreclosures is a good sign of healing in the U.S. housing market,” said Anand Nallathambi, president and CEO of CoreLogic.

Fewer foreclosures show that more people are serious about homeownership and about making on-time payments and improvements. This shows the love and pride owners are placing in their homes.

April is the best month to sell a home, according to a Consumer Reports survey of 300 real estate agents.

Spring (April, May and June) is the best overall time to sell, according to the publication.

Renewed Pride in Homeownership

Spending on home projects could set records in 2015, many analysts agree.

A recent report from Harvard University’s Joint Center for Housing Studies found the amount of spending on home improvements rose by almost $6 billion between 2011 and 2013, the first increase since 2007.

According to the report, the average homeowner spent $2,500 in 2013 on improvements. The study predicts remodeling activity will continue to rise for several reasons:

- Homeowners who can afford to move have decided to stay put

- Federal and state incentives encourage energy-efficient improvements

- Baby boomers are seeking accessibility improvements

- Owners of rental properties are reinvesting to attract tenants

What will Spring Bring?

Every real estate agent knows Spring is the busy season for both home buyers and home sellers. History tells them that.

However, this Spring could bring with it an unprecedented surge in eager buyers and sellers. With lower interest rates, better tax incentives, lower gas prices, higher employment rates, a rebounding economy and a renewed pride in homeownership, this season could bring with it a housing market revival we’ve only dreamed about.

By Charles Boggs, Jr. & Justin Waybright

Boggs & Associates, Inc.

February 12th, 2015

February 12th, 2015